RESOURCES

Blogs

Q2: Big Box Retailers and Marketplaces

August 21, 2020

2020 has been the year of the pivot. In the face of a global pandemic, all stakeholders with seats at the table of marketing (brands, platforms, publishers and most importantly, consumers) have had to drastically change their priorities and behaviors to adapt to our latest reality. This week, key bellwether big box retailers (Walmart, Target) reported second quarter earnings- the first full quarter during the COVID-19 pandemic. The numbers were astounding and for a few metrics, record breaking.

Second Quarter Earning Results: Retailers In the second quarter, Walmart’s (WAL) e-commerce sales jumped a whopping 97% and same-store sales (a key metric of retailer health and growth) jumped 9.3%. To put that into context, last year the company reported e-comm growth and same-store sales growth of 37% and 2.8%, respectively. (Source: Walmart Earnings Release) Walmart CEO Doug McMillon went on to elaborate in greater detail the company’s plan to build upon that momentum with the launch of a service called Walmart+ :

Second Quarter Earning Results: Retailers In the second quarter, Walmart’s (WAL) e-commerce sales jumped a whopping 97% and same-store sales (a key metric of retailer health and growth) jumped 9.3%. To put that into context, last year the company reported e-comm growth and same-store sales growth of 37% and 2.8%, respectively. (Source: Walmart Earnings Release) Walmart CEO Doug McMillon went on to elaborate in greater detail the company’s plan to build upon that momentum with the launch of a service called Walmart+ :

Beyond these retail behemoths, companies like Lowe’s and Home Depot also recorded phenomenal growth in the quarter, likely due to the increased focus on home improvement and DIY projects stemming from stay at home orders that came along with the pandemic. Seeing growth percent numbers in the 100s and 200s and representing dollar growth numbers in billions should be a clear signal to brands that yesterday was the best time to expand, focus, and invest in their marketplace strategy -- but as the proverb goes, today is the next best time to do so.

The Future of E-Commerce and Emerging Marketplaces It’s no secret that Amazon is not the only marketplace anymore - big box retailers are past the investment stage in their e-commerce and delivery/pick up efforts, and the landscape is now multi channel. Especially as we gear up for the holiday shopping season, brands should be focused on a targeted, sophisticated e-commerce strategy that allows them to capture the best of what each channel has to offer. Earlier in June we

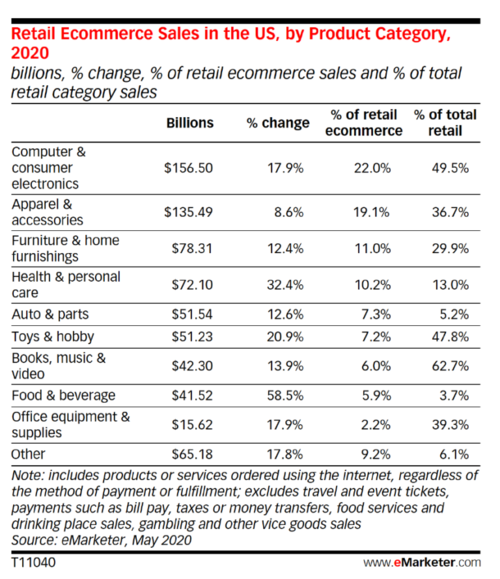

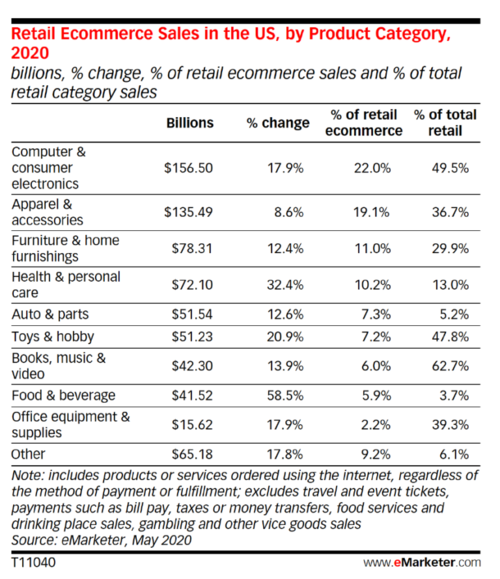

published a blog of predictions and insights around the future of e-commerce and how pandemic-driven market shifts have affected brands. We know that there are several categories not only growing their e-commerce sales but capture a greater percentage of total retail.

Beyond these retail behemoths, companies like Lowe’s and Home Depot also recorded phenomenal growth in the quarter, likely due to the increased focus on home improvement and DIY projects stemming from stay at home orders that came along with the pandemic. Seeing growth percent numbers in the 100s and 200s and representing dollar growth numbers in billions should be a clear signal to brands that yesterday was the best time to expand, focus, and invest in their marketplace strategy -- but as the proverb goes, today is the next best time to do so.

The Future of E-Commerce and Emerging Marketplaces It’s no secret that Amazon is not the only marketplace anymore - big box retailers are past the investment stage in their e-commerce and delivery/pick up efforts, and the landscape is now multi channel. Especially as we gear up for the holiday shopping season, brands should be focused on a targeted, sophisticated e-commerce strategy that allows them to capture the best of what each channel has to offer. Earlier in June we

published a blog of predictions and insights around the future of e-commerce and how pandemic-driven market shifts have affected brands. We know that there are several categories not only growing their e-commerce sales but capture a greater percentage of total retail.

Walmart, for example, in the second quarter saw strength across all of their core merchandise categories, especially in the realm of TVs, computing, and connected home. “Customers also took advantage of time for outdoor entertainment and sports, which led to strength in those categories.” noted CEO Doug McMillon. (Source:

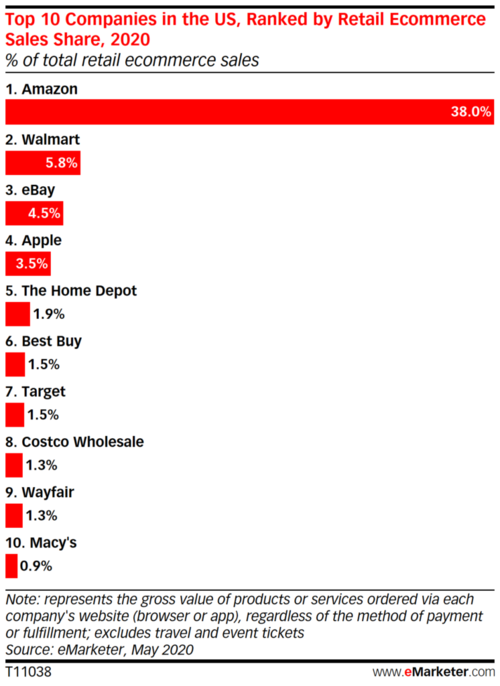

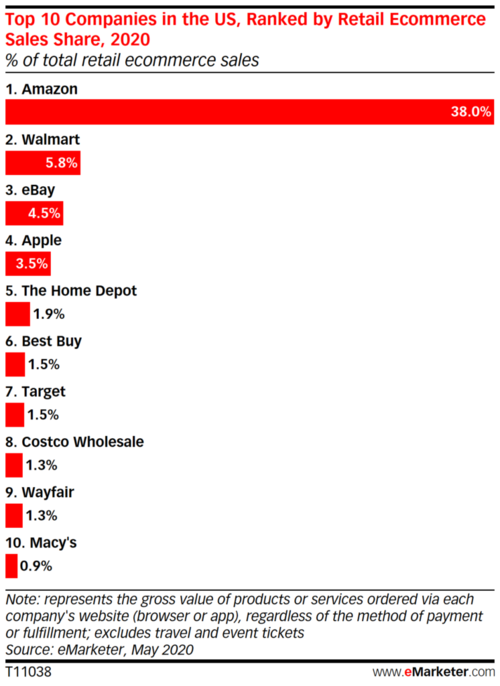

Walmart Q2 Earnings Report) While we know Amazon is still the Queen of e-commerce marketplaces, other marketplaces and point-of-sale retailers are rapidly climbing the charts. We’ve said time and time again that e-commerce is not an optional tenant of successful marketing strategies, but COVID-19 has accelerated trends around the space and emerging marketplaces can no longer be an afterthought or “check the box” exercise - your brand’s thoughtful, balanced presence across all top e-comm channels is now a strategic imperative.

Walmart, for example, in the second quarter saw strength across all of their core merchandise categories, especially in the realm of TVs, computing, and connected home. “Customers also took advantage of time for outdoor entertainment and sports, which led to strength in those categories.” noted CEO Doug McMillon. (Source:

Walmart Q2 Earnings Report) While we know Amazon is still the Queen of e-commerce marketplaces, other marketplaces and point-of-sale retailers are rapidly climbing the charts. We’ve said time and time again that e-commerce is not an optional tenant of successful marketing strategies, but COVID-19 has accelerated trends around the space and emerging marketplaces can no longer be an afterthought or “check the box” exercise - your brand’s thoughtful, balanced presence across all top e-comm channels is now a strategic imperative.

Second Quarter Earning Results: Retailers In the second quarter, Walmart’s (WAL) e-commerce sales jumped a whopping 97% and same-store sales (a key metric of retailer health and growth) jumped 9.3%. To put that into context, last year the company reported e-comm growth and same-store sales growth of 37% and 2.8%, respectively. (Source: Walmart Earnings Release) Walmart CEO Doug McMillon went on to elaborate in greater detail the company’s plan to build upon that momentum with the launch of a service called Walmart+ :

Second Quarter Earning Results: Retailers In the second quarter, Walmart’s (WAL) e-commerce sales jumped a whopping 97% and same-store sales (a key metric of retailer health and growth) jumped 9.3%. To put that into context, last year the company reported e-comm growth and same-store sales growth of 37% and 2.8%, respectively. (Source: Walmart Earnings Release) Walmart CEO Doug McMillon went on to elaborate in greater detail the company’s plan to build upon that momentum with the launch of a service called Walmart+ :

“The program will speed up deliveries for customers through curbside pickup and delivery, strengthen relationships with them and collect valuable data.”

McMillon described a familiar model, one that we’ve seen work quite well for a little-known marketplace called Amazon. Sam’s Club membership (Walmart’s warehouse retailer brand) “increased more than 60% in the quarter — the highest quarterly increase in more than five years.” The company’s e-commerce sales also grew 39%, with same-store sales rising 13.3%. (Source: Walmart) Target delivered its own record-breaking numbers, with second quarter comparable sales growing 24.3%, the highest they’ve ever recorded. The company’s e-commerce revenue almost tripled to $4B, and stores fulfilled an impressive 90% of those orders. Target also reported that their same-day services like order pick up, drive up, and Shipt grew 273%. As a result, Target estimates that in the first half of 2020, the company gained $5 billion of market share. (Source: Target) Beyond these retail behemoths, companies like Lowe’s and Home Depot also recorded phenomenal growth in the quarter, likely due to the increased focus on home improvement and DIY projects stemming from stay at home orders that came along with the pandemic. Seeing growth percent numbers in the 100s and 200s and representing dollar growth numbers in billions should be a clear signal to brands that yesterday was the best time to expand, focus, and invest in their marketplace strategy -- but as the proverb goes, today is the next best time to do so.

The Future of E-Commerce and Emerging Marketplaces It’s no secret that Amazon is not the only marketplace anymore - big box retailers are past the investment stage in their e-commerce and delivery/pick up efforts, and the landscape is now multi channel. Especially as we gear up for the holiday shopping season, brands should be focused on a targeted, sophisticated e-commerce strategy that allows them to capture the best of what each channel has to offer. Earlier in June we

published a blog of predictions and insights around the future of e-commerce and how pandemic-driven market shifts have affected brands. We know that there are several categories not only growing their e-commerce sales but capture a greater percentage of total retail.

Beyond these retail behemoths, companies like Lowe’s and Home Depot also recorded phenomenal growth in the quarter, likely due to the increased focus on home improvement and DIY projects stemming from stay at home orders that came along with the pandemic. Seeing growth percent numbers in the 100s and 200s and representing dollar growth numbers in billions should be a clear signal to brands that yesterday was the best time to expand, focus, and invest in their marketplace strategy -- but as the proverb goes, today is the next best time to do so.

The Future of E-Commerce and Emerging Marketplaces It’s no secret that Amazon is not the only marketplace anymore - big box retailers are past the investment stage in their e-commerce and delivery/pick up efforts, and the landscape is now multi channel. Especially as we gear up for the holiday shopping season, brands should be focused on a targeted, sophisticated e-commerce strategy that allows them to capture the best of what each channel has to offer. Earlier in June we

published a blog of predictions and insights around the future of e-commerce and how pandemic-driven market shifts have affected brands. We know that there are several categories not only growing their e-commerce sales but capture a greater percentage of total retail.

SIGN UP FOR OUR WEEKLY NEWSLETTER

Enter Email Address

News, Views, and Valuable Resources

Delivered to Your Inbox Each Week